The value of Ethereum has been a pleasure to look at because the begin of 2024, climbing by greater than 30% in lower than two months. The most recent on-chain revelation means that ETH traders are approaching the market with extra confidence, because the cryptocurrency’s value rally appears to be removed from over.

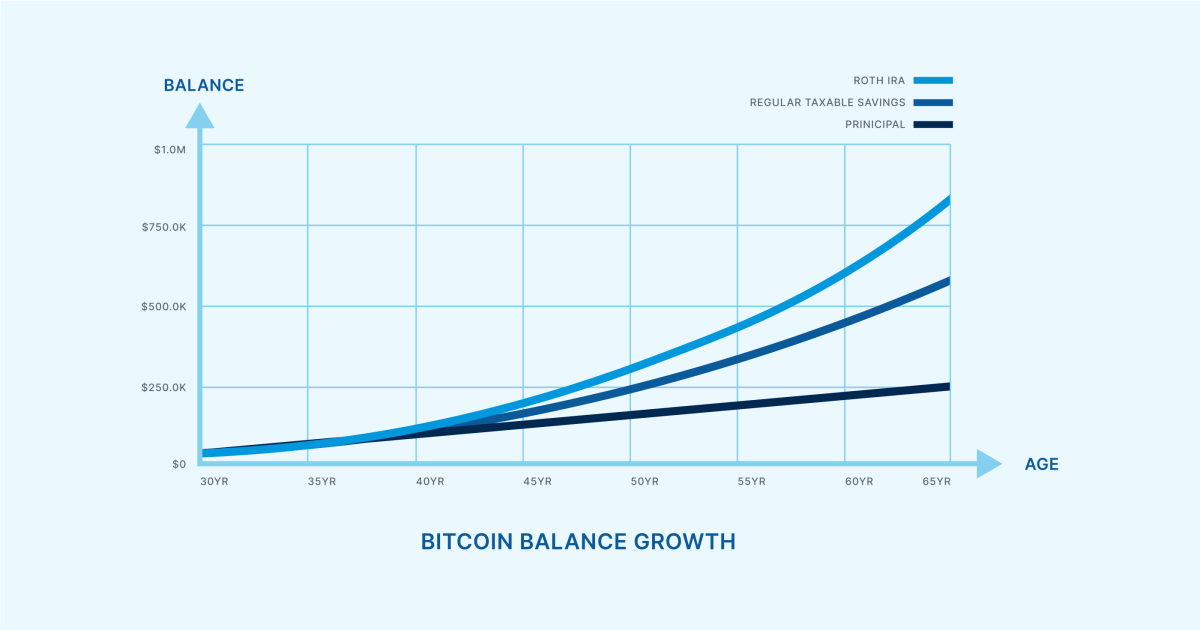

$2.4 Billion Value Of ETH Leaves Exchanges: CryptoQuant

A pseudonymous analyst on CryptoQuant’s Quicktake revealed that vital quantities of the Ethereum token have been making their means out of exchanges in the previous couple of weeks. This statement relies on the “Alternate Reserve” metric, which tracks the quantity of ETH tokens within the wallets of all centralized exchanges.

When the worth of this metric will increase, it implies that traders are making extra deposits than withdrawals of an asset (Ether, on this case) into centralized exchanges. In the meantime, the metric’s decline implies that extra property are flowing out than getting into these platforms.

In keeping with information from CryptoQuant, greater than 800,000 ETH (equal to roughly $2.4 billion) has flowed out of cryptocurrency exchanges because the flip of the 12 months. Sometimes, the motion of great quantities of cryptocurrencies out of those platforms suggests an increase in investor confidence.

Ethereum’s change reserve | Supply: CryptoQuant

Because the CryptoQuant Quicktake writer famous, this discount in Ether’s change reserve stability could possibly be a bullish catalyst for the altcoin’s value. A sustained decline within the ETH’s provide on exchanges may set off a provide crunch, probably driving the Ethereum value larger.

As of this writing, the Ethereum value stands at round $2,920, reflecting a 1.8% decline up to now day. Nonetheless, the “king of altcoins” continues to be within the inexperienced on the weekly timeframe, with an nearly 5% value bounce during the last week.

Ethereum Value Rise Due To Anticipation Of Dencun Improve: Grayscale

In a latest report, Grayscale has supplied commentary on Ethereum’s constructive value efficiency thus far in 2024. The asset administration agency tied ETH’s bullish trajectory to the upcoming Dencun improve of the Ethereum community.

William Ogden Moore, Grayscale’s analysis analyst, wrote within the report:

We consider that latest value efficiency displays the market’s anticipation of this improve, as Ethereum (up 26% YTD) has outperformed the broader Good Contract Platforms Sector (up 3% YTD) since January 1st, 2024.

The Dencun improve, which is lower than a month away, will intention to reinforce Ethereum by way of scalability and cost-effectiveness. Additionally it is anticipated to assist the community compete with “quicker chains within the Good Contract Platforms Crypto Sector, reminiscent of Solana.”

One other narrative that could be propelling the worth of ETH is the approval of Ethereum spot exchange-traded funds (ETFs) in the US. Apparently, Grayscale is amongst the asset managers trying to debut an Ether spot ETF.

Ethereum value at $2,923 on the each day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site completely at your individual threat.