A video of safety officers wrestling a protester to the ground within the foyer of the Jackson Lake Lodge in Wyoming, outdoors the Federal Reserve’s most carefully watched annual convention, clocked greater than one million views.

A protest that disrupted a speech by Jerome H. Powell, the Fed chair, on the Financial Membership of New York this fall generated intensive protection. And when the activists confirmed up once more at Mr. Powell’s speech on the Worldwide Financial Fund in early November, they appeared to get below his pores and skin: The central financial institution’s normally staid chief was caught on a sizzling mic utilizing a profanity as he advised somebody to shut the door.

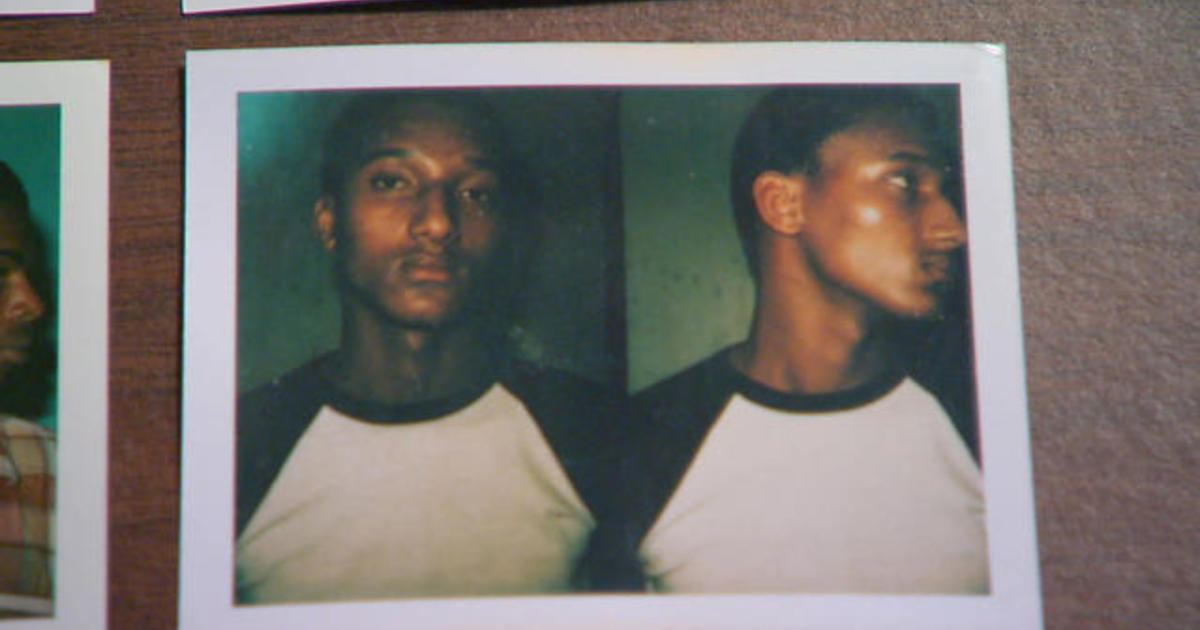

All three upheavals have been attributable to the identical group, Local weather Defiance, which a now-30-year-old activist named Michael Greenberg based within the spring. Mr. Greenberg had lengthy labored in conventional local weather advocacy, however he determined that one thing louder was wanted to spur change at establishments just like the Fed.

“I noticed there was an enormous want for disruptive direct motion,” he defined in an interview. “It simply will get so, so, so, so, a lot extra consideration.”

The small however noisy band of protesters dogging the Fed chair can also be spotlighting an issue that the central financial institution has lengthy grappled with: exactly what position it ought to play on this planet’s transition to inexperienced vitality.

Local weather-focused teams typically argue that as a regulator of the nation’s largest banks, the Fed ought to play a serious position in getting ready the monetary system for the damaging results of local weather change. Some need it to extra overtly discourage financial institution lending to fossil gas firms. Mr. Greenberg, for example, mentioned he would really like the Fed to make use of regulation to make lending to grease and gasoline firms primarily cost-prohibitive.

The Fed is unwilling — and, relying on whom you ask, probably unable — to place such a heavy thumb on the size. Whereas it polices exercise for security and soundness, central bankers typically argue that choosing winners and losers by figuring out whom banks can lend to would transcend its mandate, throwing the Fed into the political fray and imperiling its independence.

Going to date on local weather coverage that it causes political backlash might have severe implications for the central financial institution. Fed officers in Washington usually are not elected: They’re nominated by the president and confirmed by the Senate, and they’re tough to take away from workplace. That insulation exists to allow them to make robust selections that maintain the financial system working at a good keel over the long term, generally on the politically contentious worth of near-term ache.

However Congress oversees the central financial institution’s actions, and might punish it if it oversteps. To maintain its independence and wiggle room, the Fed is making an attempt to strike a stability: being attentive to the doable results of local weather change even because it tries to stay staunchly outdoors partisan debate.

“They’re making an attempt to make progress — and sturdy progress,” mentioned Sarah Dougherty, a former Atlanta Fed researcher who now focuses on monetary regulation and different points on the Pure Sources Protection Council. “They attempt to keep out of those bigger, tradition battle, political points.”

From her perspective, Ms. Dougherty mentioned, the Fed has taken significant steps this yr to enhance climate-related coverage and oversight, although she would like “extra, quicker, please.”

However some local weather activists argue that by not being extra proactive — by taking time to embrace insurance policies that the European Central Financial institution and the Financial institution of England have pioneered, for example — the Fed is slow-walking one of many world’s most essential points.

The Fed is “shamefully” behind its friends, mentioned Eren Can Ileri,who focuses on monetary regulation on the Dawn Mission, a gaggle that gives evaluation and technique recommendation for climate-focused organizers. His work on monetary regulation helped direct Local weather Defiance’s latest consideration to the Fed.

Local weather Defiance shouldn’t be Fed-specific. It blocked entrances to the White Home Correspondents’ Dinner. It has shut down or disrupted speeches by high White Home local weather officers together with John Podesta and Ali Zaidi. It upended a e book speak by Senator Amy Klobuchar.

However its 4 full-time workers members and community of protesters have change into within the central financial institution due to the Fed’s position in regulating a few of the nation’s largest monetary establishments.

“The Fed has huge energy over the extent to which banks fund the fossil gas trade,” Mr. Greenberg mentioned. He mentioned that no particular additional disruptions have been deliberate, however that extra have been doable. (Mr. Powell is scheduled to talk Friday at Spelman Faculty in Atlanta, although that’s removed from Mr. Greenberg’s dwelling turf in Washington, D.C.)

“They clearly haven’t achieved sufficient, in order that they clearly do need to be focused extra,” he mentioned.

The protest group has gained some notable supporters. Consultant Ro Khanna, a California Democrat, spoke at a latest fund-raiser.

“We have to, regardless of the establishment is, take local weather under consideration,” Mr. Khanna mentioned in an interview, urging policymakers to “have interaction with” the group.

Local weather Defiance shouldn’t be alone in pressuring the Ate up local weather points, and Democrats have lengthy known as for the central financial institution to be extra proactive.

The Fed angered lawmakers when it delayed becoming a member of a world group of central banks targeted on climate-change points — a step it will definitely took in late 2020. Mr. Powell faces common questions in regards to the central financial institution’s climate-related actions when he testifies earlier than Congress.

However Republicans have made clear that the Fed ought to tread rigorously, saying it dangers overstepping its powers.

In mid-November, a gaggle of Home Republicans prompt in a letter that the Fed and different regulators have been being influenced by world our bodies that have been finishing up “a climate-change coverage that has been rejected by Congress on quite a few events,” and warned that “it’s the accountability of Congress, not unelected bureaucrats, to find out coverage.”

The partisan divide leaves the Fed in a sophisticated state of limbo — and could also be contributing to its cautious strategy.

The Fed has taken a number of main climate-related actions simply this yr. In early 2023, it introduced particulars for its “pilot local weather state of affairs evaluation train” for the nation’s six largest banks, asking them to sport out how they could deal with climate-related shocks. And it set out local weather ideas that specify how banks ought to monitor their associated dangers.

However these efforts are sometimes much less toothy than what some abroad counterparts are doing. The Financial institution of England’s and the European Central Financial institution’s local weather stress checks for banks began earlier and are extra developed. Europe’s central financial institution has additionally structured a few of its financial insurance policies to favor greener firms.

That owes partly to the central banks’ completely different buildings; the European Central Financial institution has extra authority to deal with local weather issues, in some circumstances. Political actuality and the Fed’s innate warning additionally play a job.

Mr. Powell has been clear that the Fed must proceed cautiously.

“With out express congressional laws, it might be inappropriate for us to make use of our financial coverage or supervisory instruments to advertise a greener financial system or to attain different climate-based targets,” he mentioned this yr. “We’re not, and won’t be, a ‘local weather policymaker.’”

Lisa Friedman contributed reporting.